Health tech marketing budgets hold strong over past twelve months

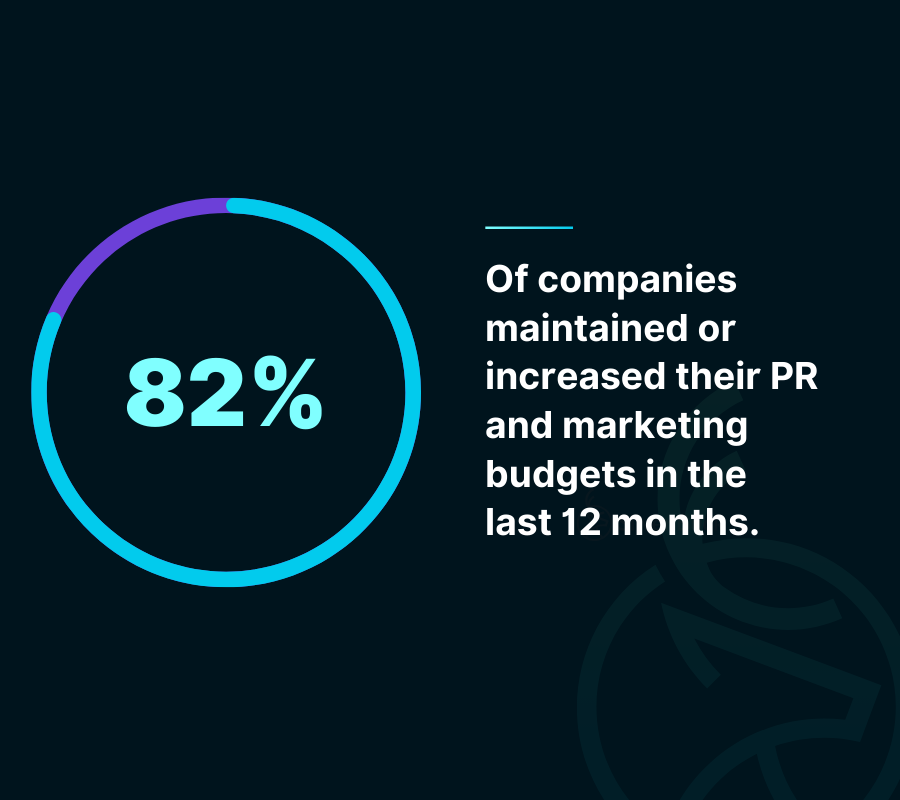

The PR and marketing budgets for health tech and digital health companies either increased or remained the same throughout 2023, despite a decrease in NHS health tech funding and VC interest.

A recent survey conducted by Silver Buck, The Health Tech Communications Agency, showed that overall, 82% of companies either increased or maintained their budgets. Start-ups and scale-ups were the most likely to increase spend (51%) followed by medium sized companies (43%) and then large corporates (21%). This trend is likely to be influenced by the high number of companies entering in the industry creating more competition combined with the drive for visibility of those looking for funding.

PR and marketing of high importance in health tech

The results show a surprisingly positive picture and recognition of the importance of communications within the industry. Ninety-seven percent of the companies surveyed also stated that PR and communication is either ‘extremely’ or ‘moderately important’ to their business.

Sarah Bruce, Cofounder of Silver Buck, said: “Marketing is often the first casualty in a downturn or correction in a sector, however, the health tech space is showing real resilience and commitment to using communications to gain or defend market share.

“Competition within an industry of over 5,000 health tech companies competing for a finite number of pilot sites, contracts, funding, or acquisition opportunities is without question, driving the appetite for strong communications.”

Budgets and impact causing biggest headaches

Despite the positive outlook, marketing professionals in the sector face challenges, with 55% citing budgetary constraints as a significant hurdle. Smaller and medium-sized companies, in particular, said they are grappling with demonstrating impact of campaigns, potentially due to prolonged sales cycles and the difficulty in tracking and converting prospects effectively.

The survey, which included responses from over 60 health tech companies, showed that trade shows, such as Digital Health Rewired, delivered the most impact (79%) in helping them to meeting their goals. This was closely followed by social media (77%). SEO and digital marketing had the least impact especially for small and medium size suppliers.

The number of health tech companies using an agency to support their PR and marketing activity is also significantly high in the sector. The results showed that 70% of respondents had dedicated inhouse staff, 56% used an agency but only 11% had freelancer agreements. Across all sizes of companies, there was a mix of inhouse and agency resource. Medium sized companies were least likely to use freelancers (0%) and only 5% of big corporates relied on them.

Health tech agencies and inhouse support help to fill skills gap

Bruce added: “What surprised us was the diversity of companies engaging with agencies. While there’s a common perception that agencies cater exclusively to large corporations, half of startups and scale-ups are also using their services. This likely stems from the difficulty in recruiting communication professionals with a deep health tech understanding and a wide breadth of skillsets.

“Additionally, there’s a need to mitigate the risk associated with hiring full-time staff. The trend underscores a broader shift in how companies, regardless of size, recognise the strategic value agencies bring to the complex landscape of health tech communications.”

With funding constraints impacting health and social care, and significant organisational restructuring through the introduction of Integrated Care Systems, the identification of clear decision makers has become increasingly challenging.

An increasingly tough market for smaller players

Fifty-eight per cent of companies said that 2023 was more difficult than previous years to sell to the NHS and 24% said it was the same. Start-ups and scale-ups faced even greater difficulty, with 61% finding it harder, compared to 50% of larger corporations. This can potentially be attributed to the importance of an established brand and clear proof points of the larger corporations in the sector.

Download the full report for free here

About the survey

The survey took place for two months between October 20th-Decemeber 20th 2023 and was taken by 63 digital health/health tech suppliers. 49% were start-up/scale-up, 11% were medium sized and 30% were large corporate companies.